Our new checking accounts offer everything you need— and nothing you don’t (including a bank). Choose between interest-earning Velocity Checking or streamlined Pace Checking.

Moolah. Dough. Cha-ching. Whatever you call it, make more of it—guaranteed—with Velocity Checking’s 2.50% APY¹. Plus, no monthly fees, available overdraft protection², get paid up to two days early³ and more.

How Velocity compares

Table information is accurate as of 07/11/2024 and is used for comparison only. Competitor’s account capabilities, including Earthmover’s, are subject to change without notice.

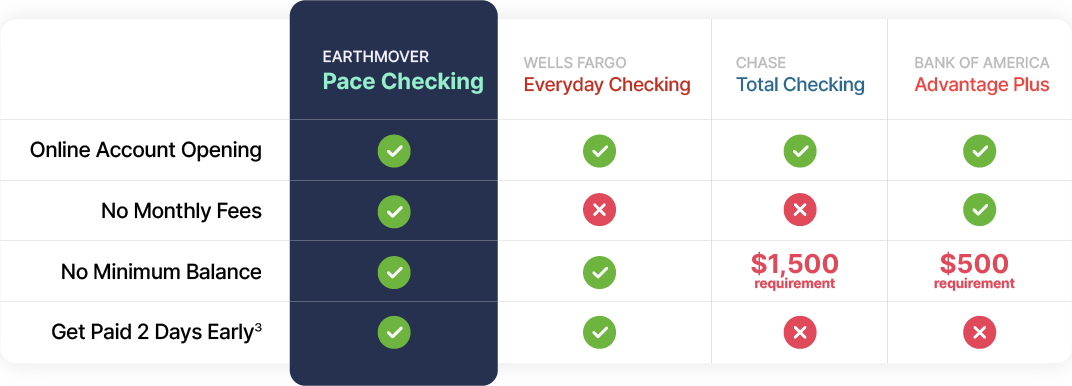

No monthly fees. Get paid up to two days early³. Access to 30,000+ fee-free ATMs nationwide. Pace Checking empowers any lifestyle.

Table information is accurate as of 07/11/2024 and is used for comparison only. Competitor’s account capabilities, including Earthmover’s, are subject to change without notice.

Both accounts come standard with

Frequently Asked Questions

Is Earthmover a bank?

We may not be a bank, but we offer all the financial tools and products a bank does, with incredible customer service focused on our "people helping people" mission.

Why is a credit union better than a bank?

Can I really open an account online?

Will I receive a physical debit card?

What does it mean to be a member of Earthmover?

Why aren’t all checking accounts this good?

Ready for some serious freedom in your wallet?

When you join Earthmover, you're part of a community of nearly 31,000 members—all part-owners of the credit union. Because we're a not-for-profit, we're accountable to one another rather than to shareholders, often offering better interest rates and perks that make being an Earthmover a joy at every step.

A few more bonuses of being an Earthmover:

Are you ready to take the next step?

The member application process only takes a few minutes and the benefits last a lifetime.

¹ 2.50% APY: APY = Annual Percentage Yield. Earthmover Credit Union membership required. In order to qualify for 2.50% APY on account balance, members must maintain a minimum account balance of $0.01, must be enrolled and active in Earthmover's Online Banking, be enrolled in paperless statements (eStatements) or be 65 years of age or older, have an active Earthmover Visa Credit Card and complete at least one (1) transaction OR make a minimum of 15 Visa debit card transactions per month with a $10.00 minimum per transaction amount (does not include ATM withdrawal), and have a total direct deposit amount of at least $500.00 in savings and/or checking. Direct deposits that are not from an employer or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g. IRS tax refunds), do not constitute direct deposit activity. 2.50% APY is only valid up to $5,000.00. Any balance greater than $5,000.00 will be paid at the stated dividend rate and APY for that tier. Dividends earned will be posted to the account on the second business day of the month following the dividend period. Offer and rate is subject to change without notice. See an Earthmover Credit Union team member for more details.

² Overdraft Protection Available: Qualified Earthmover members will have the ability to access a line of credit which will serve as overdraft protection. Not all members will qualify for this line of credit. If qualifications are met, the member will need to apply for it in order for the line of credit to be tied to their Velocity Checking Account. Non-qualifying members will have the option to opt in for Earthmovers’ Optional Overdraft Services which will protect your checking account when you don't have available funds to cover a transaction. Visit our Optional Overdraft Service Opt-In Request page for complete details on this service and how it applies to you.

³ Get Paid 2 Days Early: Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. Not every employer submits and settles their payroll early. Earthmover Credit Union generally make these funds available on the day the payment file is received, which may be up to two (2) days earlier than the scheduled payment date. If you have questions on your payroll timing, please consult your employer’s payroll department.